Maybe the difficult truth is that sustainability just is not much of a market opportunity, but rather a profound moral challenge.

And perhaps the increasingly desperate insistence that sustainability be a market opportunity is merely the means to fend off acceptance of the moral obligation.

It is becoming too late in the day to maintain the pretence that a Voluntary Market-Led approach to sustainability can achieve enough change, fast enough – for multiple social and ecological issues. Persisting with Voluntary Market-Led tactics – seeking the perfect ESG rating, formulating the ideal corporate disclosure framework, announcing the most eye-catching pledge etc., – is simply doubling down on avoidance of policy, behavioural and cultural changes now urgently needed.

It is to keep believing that markets can solve problems markets are still organized not to recognize. Markets ‘see’ prices, but – just one example – the World Bank reports less than 4 percent of global carbon is yet priced sufficiently. So-called ‘Mr Market’ has no inkling there is a climate crisis because we haven’t yet told him in the language he understands!

Like many, I hoped our sustainability challenges might yield to enlightened, voluntary actions within unchanged markets, but it is clear (and has been clear to many others for much longer) that the very mindset that casts sustainability primarily as a new ‘market opportunity’ is central to our unsustainability.

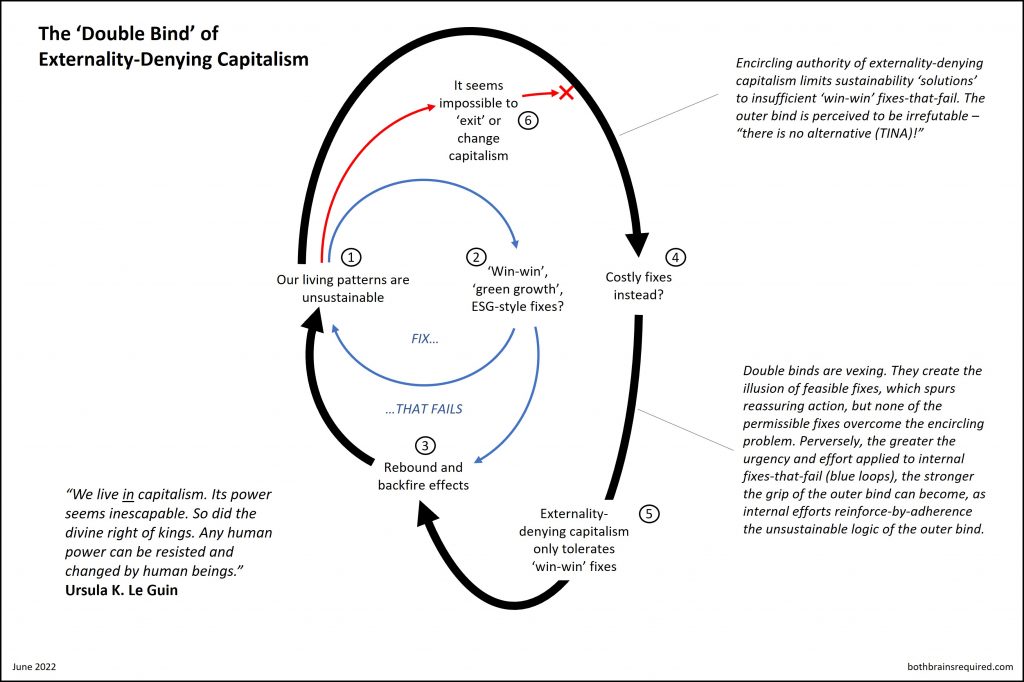

We are effectively trapped in the ‘double bind of externality-denying capitalism’ (see image). In continuing to resist solutions that might be costly or growth-detracting, we pursue with increasing urgency ‘win-win’ solutions compromised by rebound and backfire effects. At best, these foster a dangerous complacency that sufficient progress is under way. At worst, they aggravate the situation by constituting brand new ways by which we accelerate transformation of the matter and energy of the world, which is the root cause of ecological crisis.

Markets can be enormously beneficial, but – remember the theory – *only* if all costs are recognized. If that is not true, as today, then however ‘generally accepted’ profit and growth figures might be, they are not ‘fully costed’. Indeed, the flaw in our socio-economic system in a nutshell: our ‘generally accepted’ profits are not fully costed. Is any company in the world yet reporting a fully costed profit? If reported profits are not fully costed, do we want more profit or less? Who knows?! Ditto for ‘economic growth’.

In continuing not to properly internalize large and known externalities – ‘consequences’, in plain English – the capitalism we currently practice and so daily reinforce is externality-denying in character. It is innately extractive as a whole system. No ESG rating or data initiative or voluntary pledge can overcome that fundamental problem or is really trying to. Policy and moral leadership – both costly and effortful, unfortunately – just might.

Note:

Double binds were first formulated by Gregory Bateson and colleagues in the 1950s as part of the search for causes of schizophrenia. While they would not be considered a distinct cause of schizophrenia today, they are seen as a contributing dynamic in a wide range of mental health problems and dysfunctional relationship patterns.

Anthony Chaney, author of an excellent biography on Bateson, Runaway: Gregory Bateson, the Double Bind, and the Rise of Ecological Consciousness, defines double binds as follows:

“Double binds are impossible dilemmas that occur within complex systems when premises at different levels of generality contradict each other [hence the need to draw concentric or nested circles to convey different ‘levels’ of logic]. They persist because conditions prohibit communication about the contradiction. Life finds ways to live with them that are often increasingly destructive.”

While Bateson originally described double binds in relationship terms – e.g., a dysfunctional parent-child relationship (Steps to Ecology of Mind, page 206), the ‘double bind’ we have collectively fallen into with externality-denying capitalism is a system in which we are both perpetrator and victim. As Sally Weintrobe, psychologist, has expressed it:

“It is traumatising to see that you are caught up in a way of living, whether you like it or not, that makes you a victim and a perpetrator of damaging the Earth.”

Chaney’s point that ‘they persist because conditions prohibit communication about the contradiction’ rings true about the appetite mainstream business discourse has for candid discussion about concepts such as ‘degrowth’ or ‘post-growth’ etc. These would be distinctly uncomfortable topics to bring up in the corporate board room, for example. Different spaces permit different conversations.

Hence, part of the vexing character of the double bind is not that they can’t be recognized, but that they can’t – yet? – be acknowledged and discussed in the arenas where it might make a real difference.

How to escape from a double bind? Acknowledge that the logic of the outer loop is the locus of the problem and go single-mindedly after that. But, of course, easier said than done. It requires overcoming norms, incentives and even one’s sense of identity if that identity has been shaped by success within the externality-denying paradigm.

I love all of this but I do want to push the topic in a healthy direction.

I do agree that win-win, ESG, DEI are all fixes that fail. At the same time there are positive byproducts created these efforts:

– Those working in those spaces get stability and survival in the short term to come up with better ideas in the future

– Failure is a big teacher, trust in those self-appointed saviors of our is surely waning. For example the Democratic Party in US constantly fails.

– Converting individuals in broken systems. We might not have changed everything but a few people woke up to the realities of the world. This is for sure my own story over the past two years.

I love your work but I am also excited to bring in more nuance to these discussions. This system archetype truly depends on the time horizon. We might only get so many shots to loop around but maybe future generations will get even more chances.

I hope my engagement with Loss and Damage (UNFCCC) from the bowels of the finance sector and the world of actuaries meets the goals of the author’s last paragraph.

On the subject of denial of consequences capitalism – we tried our own version of a “real-verse” consequence manifestation in Canary Wharf back in 2015

https://medium.abundanceinvestment.com/je-ne-regrette-rien-the-consequences-campaign-3dc784d61aa4

So true. How come there are no comments before this one? Has it been published in a “space” that is afraid to recognise it’s truth.

All this is common-place in my world. It’s why I and others are struggling to prevent new fossil fuel extraction, and highlight “market” solutions that act as “greenwash”. My main focus is the proposed new coal mine in Cumbria, opposing it through legal means, highlighting the need to include Scope 3 downstream emissions, i.e. from the use of the coal, as a harm from the proposal. Those who stand against us claim these emissions should be controlled at the blast furnaces through markets and carbon pricing. We know they won’t, and as you say, the systems cannot yet “see” the externalities. Good to see this article though.

Love this work!